China’s motorcycle industry has earnt an unenviable reputation over the last few decades. Whether it’s because of the laughably bad knock-offs of familiar Western or Japanese bikes, low-quality reproduction parts, or something as simple as bike names that occasionally verge on the comical, if you were to ask many seasoned riders whether they’d consider a Chinese bike you’d be laughed out of the room.

But times change and those stereotypes are rapidly becoming outdated as Chinese companies take huge strides forward in terms of design, technology and sales success on a global scale. Your granddad probably never believed a Japanese bike could rival the stuff made in England, and by ignoring the advances we’re seeing in China we could be guilty of the same blinkered view.

Ideas that China can’t manufacture quality products have been debunked again and again. Check where your iPhone was made, or your Tesla for that matter. The designs might be from the West, but much of the production is Chinese. Now the nation’s own brands are using that experience to accelerate their own industries. Chinese car maker BYD has just overtaken Tesla as the world’s biggest electric car manufacturer, for instance, pumping out 526,000 vehicles in the last three months of 2023 against the American brand’s 484,500, and companies like Xiaomi and OPPO are creeping up behind Apple and Samsung in the mobile phone stakes.

Motorcycle manufacturers already know this. BMW has used Chinese, Loncin-made engines in some bikes for nearly 20 years. KTM has a joint venture with CFMoto in China. Piaggio has one with Zongshen. In each case the Chinese brand is tasked with making engines or complete bikes that meet high expectations and have no trouble hitting that mark.

The latest sales figures show that customers in the UK are starting to accept Chinese bikes as well. In December 2024, four of the eleven categories that the Motorcycle Industry Association (MCIA) splits motorcycles and mopeds into were topped by Chinese-made machines.

Leading the charge for electric bikes – the Chinese Sur-Ron Ultra Bee was the UK’s best-selling battery-powered motorcycle in Q2 and Q3 of 2023.

The fact is that while China is perfectly capable of making high-end machines its bike industry has largely chosen to make stuff that’s cheap-and-cheerful, verging on the disposable. The same low-end, low-cost bikes have also forged an export market – often for scooter riders or learners who want something that is, above all, cheap. If it’s scrap after two or three years, so what? That short lifespan suits the manufacturers, too – they can simply sell you, or more likely a different new rider, another one rather than having to supply years of servicing and parts support.

Now, though, a growing number of Chinese marques are moving up to a more mature part of the market, offering larger, multi-cylinder, high-performance bikes. These machines can’t be disposable. They need to last and prove themselves to be dependable, as customers will be looking beyond simply the purchase price but at resale value, which in turn is a key component of the sort of PCP financing that most customers rely on. High residuals make for low monthly payments, so in order to be easy on our wallets the bikes need to be long-lived and easily resaleable.

China also has a huge head-start when it comes to electric bikes. Battery-powered scooters dominate the market over there, having outsold combustion-engine versions for years, so there’s both a huge electric bike manufacturing industry and a depth of engineering knowledge to tap into.

Benelli’s BN125 is the best-selling Chinese bike in the UK at the moment

What are the best-selling Chinese bikes in the UK?

Right now, it’s still small-capacity, low-cost stuff that leads the way when it comes to Chinese motorcycles sold in the UK. Digging into the new vehicle registration statistics published by the DfT and DVLA shows that in the third quarter of 2023 – the most recent numbers available at the time of writing – the best-selling made-in-China model sold here in that period was the Benelli BN125. With 294 sold in the three-month period it was the eighth best-selling bike in the country. It’s not a flash-in-the-pan, either, as the same model – which wears an Italian brand name but is made in China by Benelli’s parent company, Qianjiang – has been putting in three-digit quarterly sales since its launch in 2021.

To put that number into perspective, Honda’s XL750 Transalp, one of the most anticipated new bikes of the year, which only reached the market in Q2 of 2023 and has been subject of plenty of publicity, found 273 customers in Q3, putting it in 10th place in the charts.

Other strong-selling Chinese machines included the Keeway RK V 125 C with 151 sold in Q3 2023. Keeway is another of Qianjiang’s brands, alongside Benelli and the QJMotor marque that has yet to enter the UK market, and Benelli is now referred to as being part of the Keeway Group.

Next comes the Benelli TNT 125 on 144 sales, and the Lexmoto LXR 125 sports bike on 135 sales (Lexmoto is a UK-only name, but the bike is the Chinese Taro GP2 125).

Again, some perspective is needed to understand those numbers, and the best way is to see how those machines compare to the sales of more familiar rival models. When it comes to the Keeway RK V 125 C that’s tricky – it’s a 125cc V-twin cruiser, with few direct rivals other than the same brand’s V Cruise 125 (78 sales in Q3). However, the Benelli TNT 125 is a 12-inch wheel fun bike, up against the Honda MSX125 Grom, which sold 187 examples in Q3, just 43 more than the Benelli. The Lexmoto LXR 125, meanwhile, is a sports bike to rival the likes of Yamaha’s YZF-R125, which trailed behind its Chinese-made rival on 124 registrations in Q3 2023.

What are the best-selling Chinese-made bikes under 125cc in the UK, Q3 2023

|

1

|

Benelli BN 125 E5

|

294

|

|

2

|

Keeway Superlight 125 ES

|

171

|

|

3

|

Keeway RKV 125

|

151

|

|

4

|

Benelli Tornado Naked T 125 E5

|

144

|

|

5

|

Lexmoto LXR 125

|

135

|

|

6

|

Jiajue [model missing]

|

134

|

|

7

|

Surron Ultra Bee

|

123

|

|

8

|

Lexmoto LXS 125

|

89

|

|

9

|

Lexmoto ZSB 125 EFI

|

83

|

|

10

|

Keeway V-Cruise 125

|

78

|

|

11

|

VMoto CPx

|

78

|

|

12

|

Lexmoto Michigan 125

|

77

|

|

13

|

Lexmoto Aura 125

|

74

|

|

14

|

Keeway K-Light 125

|

73

|

|

15

|

Lexmoto Echo

|

69

|

|

16

|

Lexmoto Diablo

|

63

|

|

17

|

Sinnis Terrain 125

|

62

|

|

18

|

WK Bikes Scrambler 125

|

62

|

|

19

|

Voge R 125

|

61

|

|

20

|

Lexmoto TR 125-2 LXR 125 SE

|

58

|

|

21

|

VMoto TC Max

|

58

|

|

22

|

WK Bikes Scrambler 50

|

57

|

|

23

|

Surron Light Bee

|

56

|

|

24

|

Lexmoto Assault 125

|

54

|

|

25

|

Keeway Versilia 125

|

53

|

Yes, it’s a KTM. Yes, it’s made in China.

What are the larger-capacity Chinese bikes?

So China’s small-capacity bikes are starting to take a serious slice of that market in the UK, but surely the same doesn’t apply when we look higher up the food chain, does it?

It’s a little harder to make direct comparisons here, simply because there are relatively few large-capacity Chinese bikes on the market in the UK yet, but there are indications that where they offer the right combination of price and quality, riders are happy enough to put money into a Chinese-made machine.

The best-selling big Chinese-made bikes are those that you might not have realised come from that country. KTM’s 790 Duke, for instance, which returned to the market in 2022 and is manufactured at KTM’s joint venture with CFMto in China, was the company’s third-best seller in Q3 2023, finding 126 buyers in that three-month period. The 790 Adventure, made alongside it, found 98 customers in Q3 to be the brand’s fifth-best seller. Both outsold their more expensive, Austrian-made ‘890’ equivalents by a wide margin.

But those are, perhaps, outliers. After all, they’re European-designed, wearing a familiar European badge and many buyers probably don’t even know or care which factory they emerge from. So what about the best-selling all-Chinese big bikes?

Using those rules, the best-seller over 125cc is the Voge Rally 300. Voge is the export-focused brand of BMW’s Chinese partner, Loncin, and still very new to the UK market. The Rally 300, which didn’t reach dealers until the middle of 2023, found 50 customers in the third quarter. The same number of people, 50, opted for Benelli’s TRK502 and TRK502X models, both made by Qianjiang, with the newer, larger capacity TRK702 and 702X finding 31 buyers even though sales didn’t start until Q3 2023 was already underway, suggesting the 702 is poised to become one of Benelli’s best sellers.

A bigger surprise still comes from the next Chinese bike in the list – the Kove 450 Rally (below). OK, so only 12 were registered in Q3, but the Kove brand is completely new to the UK and still finding its feet here. It’s not a cheap bike, with an RRP of £8,500, although as a hardcore rally machine with an impressive 52hp from a 449cc single its rivals are more expensive still, even including the likes of KTM’s £30k-plus 450 Rally Replica. For 2024, it will face new competition from fellow Chinese brand Keeway in the form of the TX450R, which is less powerful at 43hp but likely to be cheaper, with a similar stance and style.

Kove is worth keeping an eye on in the future, too. The brand’s range in China – but yet to be offered here – includes the intriguing 450RR four-cylinder sports bike and the 800X Super Adventure, using a big parallel twin.

Best-selling Chinese-made bikes over 125cc in the UK, Q3 2023

|

1

|

KTM 790 Duke

|

126

|

|

2

|

KTM 790 Adventure

|

98

|

|

3

|

Voge Rally 300

|

50

|

|

4

|

Benelli TRK502

|

27

|

|

5

|

Benelli TRK502X

|

23

|

|

6

|

Benelli TRK702X

|

17

|

|

7

|

Kove 450 Rally

|

12

|

|

8

|

CFMoto 800MT Touring

|

11

|

|

9

|

CFMoto 450 SR

|

9

|

|

10

|

Benelli 502C

|

8

|

Kove 450 Rally is selling surprisingly strongly in the UK

Where’s CFMoto?

Of all the bike brands in China that look like they’re set to become serious players in the West, CFMoto leads the way with a convincing-looking range of high-tech, modern bikes and that all-important tie to KTM for an added layer of credibility.

You’ll notice that CFMoto’s bikes haven’t appeared among the best-sellers mentioned here, so what’s happened? The answer is that KTM has taken over the distribution and marketing in this country and much of Europe from the start of 2023 and the registration figures for the year suggest there’s been a stuttering start to the new arrangement. The best-selling CFMoto in Q3 2023 was the 800MT, with 12 registered (11 Touring versions, 1 Sport model). The new 450SR sports bike, just reaching the market in mid-2023, found nine British customers in Q3. But those figures aren’t likely to be an accurate representation of demand: we need to wait until the supply chain and dealer network is properly up to speed before making a judgement on CFMoto’s success in breaking into Western markets. CFMoto also has several intriguing new models planned for later in 2024, including the 500SR four-cylinder sports bike (below).

Coming soon: CFMoto 500SR, due for launch this year, could shake up the four-cylinder sports bike market

Who owns which Chinese motorcycle brand?

A hurdle faced by many Chinese bike companies wanting to get into other markets is that of brand recognition – the simple fact that customers are more likely to put money into a bike with a familiar name than risk it on an unknown one.

Note that CFMoto sales remain small in the UK while KTMs made by CFMoto and powered by some of the same engines are flying out of the door. Is that down to the looks and abilities of the bikes, the number of dealers, or because customers are more familiar with the KTM name?

That last element is certainly an important one, never illustrated better than by the example of Benelli.

Benelli might have been around since 1911 but the original iteration of the brand petered out in the 1970s, having suffered the same beating at the hands of the influx of Japanese bike as many of its European contemporaries. The company’s relaunch in 1999 with the Tornado Tre brought attention but relatively few sales, and by 2005 the company was bought by China’s Qianjiang Group. Since then, progress has been relatively slow but the Benelli range has been gradually replaced with Chinese-manufactured machines that are closely related to bikes from other Qianjiang brands, which include QJMotor and the Keeway name that’s used on QJ products in many export markets, including the UK. Indeed, Benelli is now referred to as part of the ‘Keeway Group.’

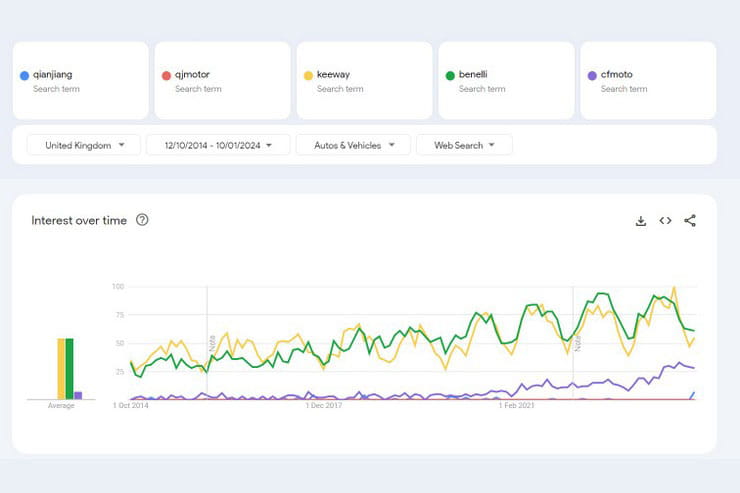

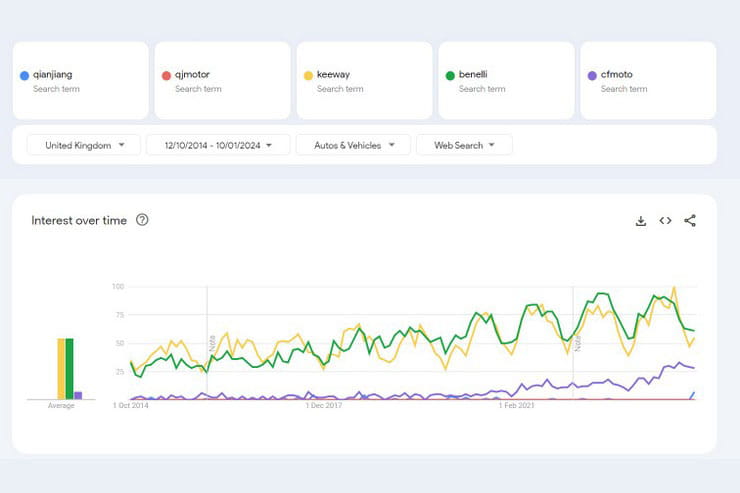

The graph here shows the level of Google searches made in the UK for the names ‘Benelli,’ ‘Keeway,’ ‘Qianjiang,’ ‘QJMotor’ and ‘CFMoto’ over the last decade, and it clearly illustrates the importance of brand awareness. Both Benelli and Keeway, which have been on the market in the UK throughout that period (green and yellow lines), get substantially more searches than CFMoto (purple line), although CFMoto is now catching up. Meanwhile the company behind Keeway and Benelli, Qianjiang (blue line) and its main Chinese-market brand, QJMotor (red line) both get virtually no searches in the UK. That may change, as QJMotor – which didn’t even exist as a brand until a few years ago and is still not available in the UK – has been the main thrust of Qianjiang’s recent efforts and has now expanded to Europe and the USA with a fast-growing range that for 2024 even includes an MV Agusta-powered four-cylinder superbike, the 921RR as well as a host of other models.

Other companies following a similar route include Loncin, with its export-focussed Voge brand that’s starting to make headway in the UK and Europe. Voge’s range is also expanding fast, ranging as high as the 900 DSX, which uses the BMW parallel twin engine from the F900 range – already made on BMW’s behalf by Loncin – in the same way that CFMoto’s 800MT and 800NK use the KTM-designed LC8c twin that CFMoto makes for the Austrian company.

A different approach comes in the form of the strong-selling Lexmoto small-capacity bikes. Lexmoto is a UK-only brand, not seen elsewhere, and it’s applied to bikes from multiple different Chinese companies. These include some of China’s biggest motorcycle brands, like Zongshen, which sells bikes to be rebranded as Lexmotos here while offering them under its own name in other countries. Other Chinese bikes imported and rebranded as Lexmotos include the brand’s best-selling LXR125 sports bike, which is made by Taro (sometimes styled as Tairong) in China – a company with a strong range of sports bikes, roadsters and scooters up to 400cc on the market over there.

Other Chinese names to keep an eye on include Zontes, a brand of the Guangdong Tayo Motorcycle Technology Co (alongside Tayo, Haojiang and Kiden), which is already available in the UK selling a range of single-cylinder bikes from 125cc to 350cc but has recently unveiled a pair of 700cc three-cylinder machines, the 703F adventure bike and 703RR sports bike, which are due to reach production in the coming months.

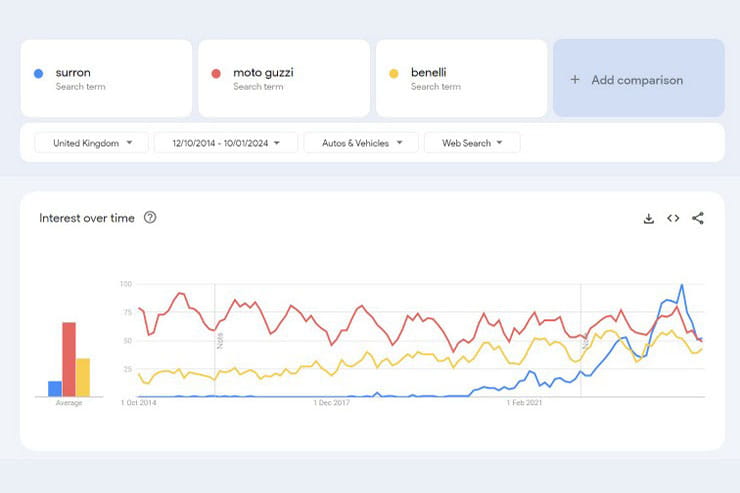

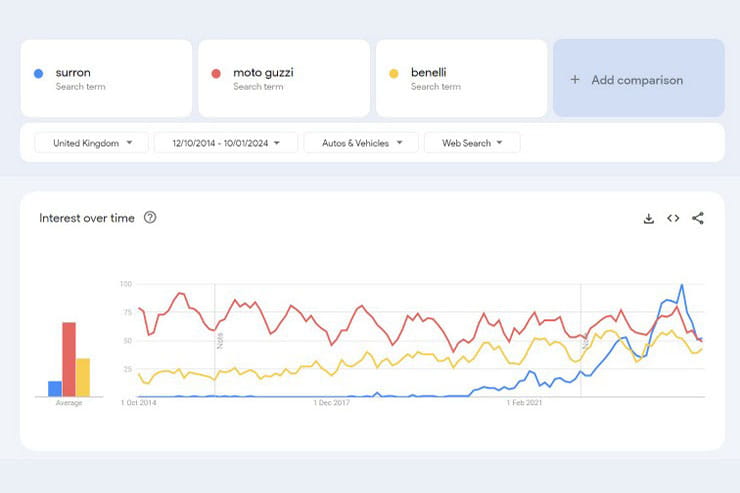

While brand awareness is something that usually grows with time, and as the Benelli example shows, can linger on for decades – explaining why so many old bike names are snapped up and reintroduced, even if modern customers don’t have a direct experience with them – sometimes something new can get the jump on them. That’s the case with the most successful electric motorcycle brand in the UK at the moment, Sur-Ron. Its Ultra Bee model outsold all other battery-electric bikes in both Q2 and Q3 of 2023, with 123 sales in Q3 and a total of 238 across both quarters, easily beating the second-placed VMoto CPx (another Chinese offering). Google Trends analytics show searches for Sur-Ron, sometimes written as Surron, have rocketed since 2021, coming from nowhere to the point where the company is now more searched-for than any other Chinese brand, including Benelli, and even gets more searches than legendary names like Moto Guzzi. Sur-Ron only reached the UK market in 2018 but has since sold nearly 2000 road-going electric bikes (1878 have been registered by the DVLA) and sales of off-road-only Sur-Rons are likely to be even higher than that.

China goes big

The relatively large number of learner-legal 125cc bikes and electric models from China that have been sold over the last few years in the UK means there’s a generation of new riders who’ve already experienced Chinese machines and perhaps don’t have the same preconceptions about them as older motorcyclists. That means the ground has been prepared for the next stage, as Chinese companies start to venture into larger-capacity and more expensive bikes.

We’re already seeing it happen. CFMoto’s UK range extends to 800cc with the 800MT and 800NK parallel twins, and in China it goes as far as 1279cc with the huge 1250TR-G V-twin tourer. Voge currently offers bikes up to 650cc here, but the recently-launched 900DSX is likely to follow.

Those bikes are all derived from existing European engine designs, though, with CFMoto using KTM parts and Voge borrowing BMW bits. The real intrigue from China at the moment is the sudden explosion of higher-performance three and four-cylinder designs that are springing onto the market, just when Japanese and European bike makers are starting to turn down their fossil-fuelled combustion engine development and plough money into electric or hydrogen-powered alternatives. China’s industry already has more EV experience than other countries, as electric scooters have dominated sales there for years, but when it comes to high-performance bikes the consensus there appears to be that ICE remains the way forward in the immediate future. The writing may be on the wall for internal combustion, with various plans around the globe to phase it out in favour of zero-emission alternatives, but China seems intent on catching up before that technology gets replaced.

The list of interesting Chinese bikes to have been revealed in the last few months alone puts much of the established motorcycle industry to shame. CFMoto has teased its 675SR, a three-cylinder, 675cc sports bike with over 100hp that’s due to be launched soon, as well as an even more unusual 500cc four-cylinder sports bike, the 500SR. The latter goes into bat against the Kove 450RR which is likely to reach the European market sooner rather than later and both will be alternatives to Kawasaki’s new Ninja ZX-4RR. Late last year another little-known Chinese brand, Yingang, showed its own 400cc four-cylinder sports bike, the 400RR, in the same part of the market. Meanwhile, Qianjiang has a different approach to the small four-cylinder, offering the QJMotor SRV 500 – a V4-powered cruiser like a miniature Yamaha V-Max – in China. There’s a good chance that the same engine and chassis could be restyled and sold over here as a Benelli in years to come, and QJMotor itself is already selling the bike in some other European countries, with a €6950 price tag that would equate to just £6k here.

The Chinese interest in sports bikes means there’s also a rash of new, larger-capacity four-cylinder offerings either hitting the market now or set to be available shortly. These include a rash of new QJMotor models – all set to be reaching Europe as well as China. At last year’s EICMA show in Milan, the company unveiled the SRK 800RR sports bike using 100hp, 778cc engine that looks a lot like Honda’s CB650R four. It also showed the SRK 1000RC, using MV’s 1078cc four-cylinder engine with 142hp, wrapped in styling by British design legend Adrian, and at the Beijing show that followed, QJMotor revealed the SRK 921RR, also with MV power in the form of a 127hp, 921cc version of the engine. The smaller MV-powered model has already gone on sale in China, and the larger version is expected to follow suit.

The power figure might seem low in comparison to the 200hp-plus machines that we’re spoilt with in the West, but all these bikes represent a huge leap forward for China’s motorcycle industry.

The same Beijing event also saw the unveiling of several other four-cylinder models, including one from European-focused Voge, the RR666S with a 100hp, 660cc inline four, and the Zongshen Cyclone RC680R with a similar power figure from a 680cc four. Both feature high-end components including adjustable suspension, Brembo radial brakes and single-sided swingarms, and have a decent chance of reaching export markets once production is in full swing. Zontes – a brand that’s already on the market in the UK – is also getting in on the multi-cylinder game with a pair of 699cc triples, which were shown at EICMA in November and intended to reach production soon. The 703RR sports bike is claimed to make 109hp at 11,000rpm, while the 703F adventure bike uses a tuned-down version of the same motor with 100hp at 9,000rpm. Both have Brembos, USD forks, TFT displays and tech including on-board cameras.

Adrian Morton-styled QJMotor SRK1000RC Ten78 uses a 147hp, 1078cc MV Agusta engine

Where next for Chinese bikes?

China’s industry has its sights set higher still. CFMoto, for instance, has already filed patents for a V4 superbike engine that’s intended to make more than 200hp, and has made it clear that the company – which already sponsors bikes in Moto3 and Moto2 – has its sights set on a top-level MotoGP entry in the future. Whether that turns out to be based around a satellite KTM bike or an out-and-out prototype of its own, the result should be a huge increase in awareness of the brand around the globe.

It’s all a far cry from the days, not that long ago, when Chinese bikes were the subject of derision. Sure, there are still plenty of knock-offs out there, and several of the new four-cylinder engine projects are based to some extent on reverse-engineering existing Japanese designs, but Japan’s fledgling bike industry also borrowed from existing knowledge back in the 50s and 60s and soon overtook the very companies that they’d copied from. Like it or not, China’s progress to becoming a motorcycle manufacturing powerhouse on a global scale looks unstoppable, and the results should be lower costs and an even broader choice for riders in the future.

Are Chinese bike cheap to insure?

You would have thought that with a lower-than-average price point, bikes made by Chinese manufacturers are likely to come with a lower-than-average insurance premium cost too, despite the apparent difficulties in obtaining replacement parts. According to Bennetts Motorcycle Insurance data, the c.1,000 Chinese-made bikes covered - with Lexmoto being the most popular manufacturer - come with an average premium of £161.33. For comparison, compare that to the average premium for the 9,300 Hondas of £175.30.

Additional reporting: Michael Mann

If you’d like to chat about this article or anything else biking related, join us and thousands of other riders at the Bennetts BikeSocial Facebook page.