Reminder: no more tax discs from 1st October

By Michael Mann

BikeSocial Managing Editor. Content man - reviewer, road tester, video presenter, interviewer, commissioner, organiser. First ride was a 1979 Honda ST70 in the back garden aged 6. Not too shabby on track, loves a sportsbike, worries about helmet hair, occasionally plays golf and squash but enjoys being a father to a 7-year old the most.

28.08.2014

No tax disc required from 1st October

Vehicle Tax becomes non-transferable

Direct Debit payment scheme introduced

Police to use cameras to check number plates for tax evaders

Sell your bike and you’re responsible for cancelling tax

Refunds for each full month remaining only

Buy a bike and you need to buy tax before riding

In less than five weeks, from 1st October, you will no longer be required to display a tax disc. Even though there will be no physical paper disc to refer to, owners will still need to have vehicle tax to ride or keep their bike on the road, or be faced with a hefty fine. The Driving & Vehicle Licensing Agency (DVLA) will continue to send reminders when the vehicle needs taxing but there won’t be a tangible disc with perforated edging to fumble with and inadvertently tear.

And on that point, a couple of national newspapers have today reported that because the DVLA (not the Post Office) are running down stocks of the perforated paper, owners who are taxing their vehicles are being told to cut out their own tax discs!

A DVLA spokeswoman said: “The benefits of a paper tax disc have become redundant over time as DVLA and the police now rely on DVLA’s electronic vehicle register and ANPR technology to check if a vehicle is taxed or not."

No more ‘Taxed & Tested’ adverts

Under the new regulations, be aware that when it comes to selling your bike the tax is not, repeat not, transferable – much like insurance. When there is a change of ownership, the seller is responsible for informing the DVLA via the normal method of completing the relevant section of the V5C. The seller will then automatically receive a refund for any full calendar months remaining which is the slightly contentious part. Already many social media users have noticed the loophole here and have chosen to point an accusatory digital finger at HM Government’s refund policy; if a motorbike is sold in the first week of February, the owner will not be entitled to a refund for the remainder of February whilst the new owner will be paying the tax from the day they buy the bike.

However, according the DVLA, the benefits are listed as: money saved on postage, more flexible payment options and of course clamping down on the tax evaders. We won’t be the only ones saving money though, after all 42.2 million tax discs were issued last year, just imagine how much special perforated paper costs.

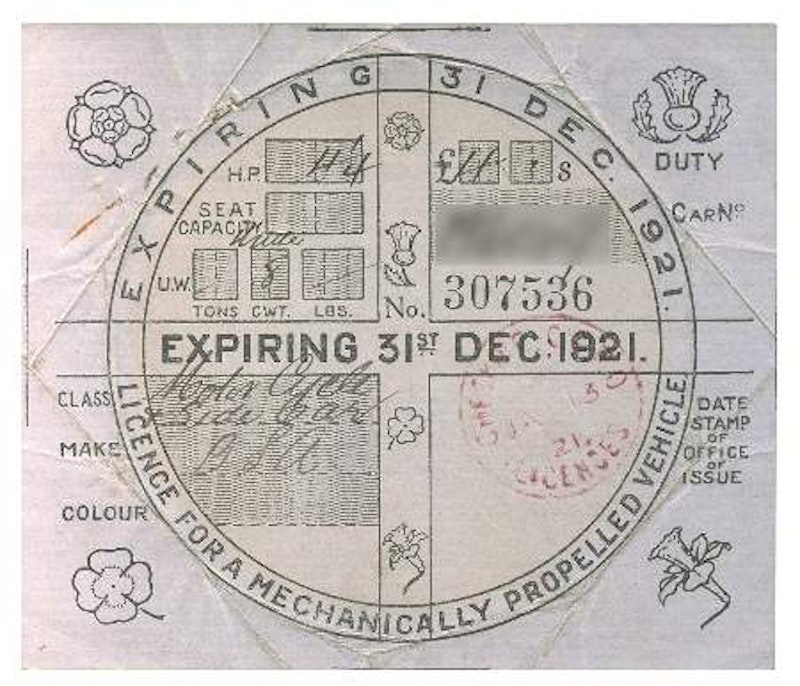

Tax discs have been in operation since 1921 and now, almost 93 years later, we'll see the last printed version as digital technology takes over.

Photo credit: ‘Trade and collect tax discs’, a Collecticus book

Selling or Buying a Bike

If you sell your bike then under the new rules you are responsible for cancelling any remaining tax by informing the DVLA. You will be entitled to a refund for any full months remaining. The refund will be issued automatically when notification is received that the vehicle has been:

Sold or transferred

Scrapped at an Authorised Treatment Facility.

Exported

Removed from the road and made a SORN

Changed to an exempt tax class

When buying a bike you must tax the vehicle before riding. If the bike is untaxed then the fine will be handed out to the rider, not owner. Use the New Keeper Supplement (V5C/2) and do it online, via the 24/7 automated phone line or at the Post Office.

The payment options are three-fold:

Every 12 months

Every six months

Every month via Direct Debit (commencing November)

Currently the surcharge of paying for six months tax at a time is 10% but from 1st October this six month option or the new monthly option will only incur a 5% increase. If the MOT remains valid then the Direct Debit payments will continue automatically until you instruct the bank to stop, you no longer own the bike or a SORN has been made.

You can check the tax status of any vehicle here: https://www.gov.uk/check-vehicle-tax

Share on social media: